The Rise and Fall of a Cannabis Giant

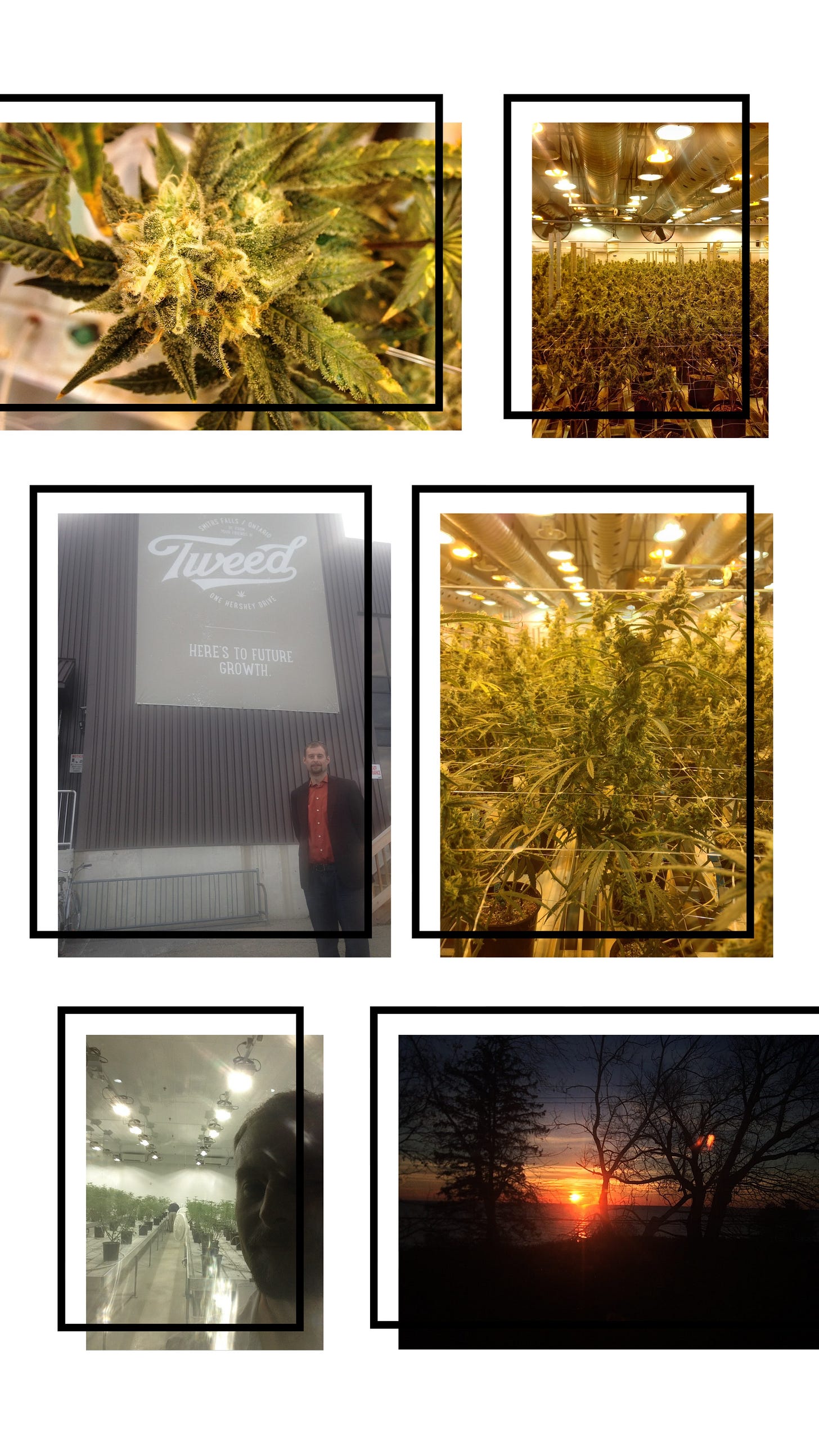

In November 2016 I toured the rapidly-expanding Tweed cannabis operation in Smith's Falls. Now it's 2023 and the plant sits empty.

On November 10, 2016 I had the privilege of touring Tweed's now-shuttered cannabis growing facility in Smith's Falls. It was the first time that I had ever seen growing cannabis up close, and I was intoxicated by the wonderful smells coming from the flowering rooms. At the time, Tweed, which was in the process of becoming Canopy Growth Corporation, was on top of the weed game in Canada. They had the majority of the medical cannabis market share, in part because of their somewhat shady partnerships with cannabis clinics, who simply signed their clients up for Tweed's products, as happened to me, without informing them of their other other options.

I was invited to tour the facility by the VP Communications after I had published an op-ed in the National Post that was sharply critical of Tweed's business practices. It was ultimately those problematic practices that were the downfall of the company. Led by the brash CEO Bruce Linton, the company bought up as many of the smaller cannabis companies as they could, in an effort to build a brand portfolio that would appeal to both medical and recreational users. At the same time, they spent millions building indoor growing facilities in the old Hershey plant in Smith's Falls, thinking that they could scale their cannabis growing operations in order to tap into all the various cannabis markets, from high end connoisseurs to bulk purchases of generic mids.

Competing with the other large producer, Aurora, based in Calgary, Canopy Growth Corporation, which now considered Tweed to be one of their many brands, received a major investment from an American beverage company called Constellation. They quickly realized that all of the corporate purchases that Canopy had been making were putting the company at risk: instead of creating a diverse portfolio that could turn a profit, Canopy had bet it all on consolidating large scale production. The problem was that cannabis can be a difficult plant to work with if you're not familiar with its various complexities. Plant health is a lot harder to ensure when you have gigantic grow rooms; all it takes is a sudden outbreak of powdery mildew and the entire room has to be destroyed.

However, Constellation had its own issues. First and foremost, they were not a cannabis company, but a beverage company. Their corporate executives were familiar with the Consumer Goods Sector, marketing alcoholic beverages in the United States, which had a very different regulatory environment than Canada had. They put a halt to Linton’s buying sprees, and they used their investment power and board seats to oust him from his position at the head of the company, installing their own preferred man, another nameless corporate face that knew neither the Canadian consumer goods sector, nor the Canadian cannabis sector. Canopy Growth Corp, now led by Consetellation, continued to flounder as it tried to be everything to everyone.

These problems were not limited to Canopy Growth. While Aurora was not the M&A happy company that Tweed was, it too bet it all on scaling up cannabis growing, thinking that the now legal recreational market would be willing to buy mass-produced cannabis. Like Tweed, their flagship building Aurora Sky, which is on-site at the Edmonton Airport, has been shuttered.

Five years into the legal cannabis regime, there have been some wins and some losses for cannabis consumers. The companies that we expected to be on top were dethroned as the market demanded quality cannabis at reasonable prices. The black market, floundering but still alive, was able to continue supplying small-batch cannabis, albeit at much lower prices than in previous years. This meant, in part, that the mass-produced ‘mids’ that were coming out of Canopy Growth and Aurora failed to register with the discerning customer. As unsold cannabis piled up in their warehouses, crop failures took their toll.

While Aurora realized that mass production was not the future of cannabis and pivoted to the medical cannabis market, Canopy Growth, led by Constellation’s hand-picked executives, heavily influenced by their mass marketing success in the Consumer Goods Sector, continued on the same path. Eventually, with no one buying their products, they were required to take massive write-downs, tanking the company value even more. Forced to shut down acquired brands and unable to produce quality harvests in their massive Smith’s Falls grow rooms, Canopy Growth has faded away. At the end of 2023, only five years into the legal market, the Coke of the cannabis world has instead become the Nokia of the cannabis world, somehow still alive, a hollowed shell of what it once was.